Residential mortgage how much can i borrow

This simple tool requires just three pieces of information the amount you want to borrow the interest rate and the amortization period commonly 25 years. For Intermediary use only.

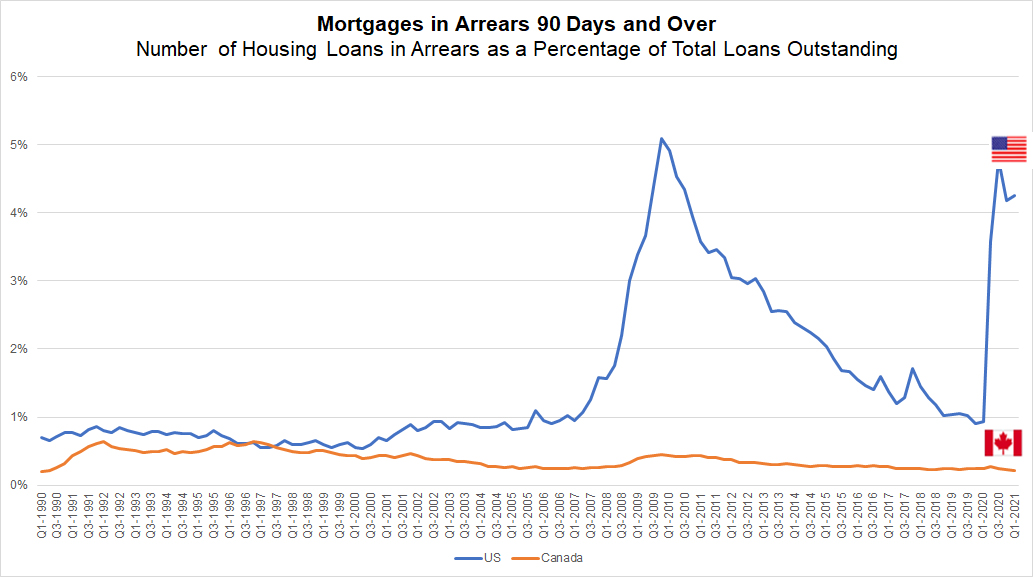

Focus Household Borrowing In Canada Focus Household Borrowing In Canada

Investment property mortgage rates can range from 50 to 875 basis points higher than rates on a primary home.

. Change the deposit you can provide or the amount you want to borrow to see how that affects your result. How much can I borrow. Find out how much you can afford to borrow with NerdWallets mortgage calculator.

It has since expanded its mandate to improve Canadians access to housing. If you entered into a home loan before 23 October 2018 and havent been advised that your loan is moving to one of the above interest rate types see applicable rates here. In addition average rates continued to march upwards with both the average overall two- and five-year fixed rates rising for the 11th consecutive month.

Size of your deposit. As an example if mortgage rates for a 30-year fixed-rate mortgage on an owner-occupied home are averaging about 325 you might expect a 30-year investment property loan to have a 375 to 4125 interest rate. LMR 250 As of 11 August 2022 For Intermediary use only.

Conventional and Jumbo Loans Find the right mortgage for your needs with fixed and adjustable-rate options for both conventional and jumbo loans. Read our How much can I borrow for a mortgage guide. The number of available products in the residential sector fell by 517 over the month to leave just under 3900 on offer for September.

Fill in some simple details find out today. Loan to Value LTV This is the amount of the mortgage expressed as a percentage of the property value. It was originally established after World War II to help returning war veterans find housing.

How much your buy to let mortgage will cost you will depend on several factors the main ones being. Residential Mortgage Products Rates Criteria. The amount of your deposit and how much you can set aside for monthly mortgage payments.

As of December 2020 the average home price in the UK was 251500. Simply select the. Our residential calculator has been built with you in mind.

How much do houses cost. Over 170000 positive reviews with an A rating with BBB. How Much Can You Afford to Borrow.

The main factors determining your monthly mortgage payments are the size and term of the loan. This is a handy step to take before you contact your mortgage broker so that you can see the effect different interest rates and loan periods will have on the amount of money you can borrow. They typically request at least 5 deposit based on the value of the property.

2021 stamp duty should return to the original threshold for all residential property purchases valued over 125000 with rates. If a house is valued at 180000 a lender would expect a 9000 deposit. Pay off higher interest rate credit cards pay for college tuition.

Canada Mortgage and Housing Corporation CMHC is a Crown Corporation of the Government of Canada. Borrow from 8 to 30 years. If you choose to use lenders mortgage insurance to increase your borrowing power you can choose to add it to the loan balance though keep in mind this means youll pay interest on it.

The bigger deposit you can put down the smaller the mortgage youll need to borrowLenders will usually ask for 25 of the propertys value although it can be higher. Whether you are securing a mortgage for the first time or refinancing your existing mortgage predicting your payments can help you budget more effectively. Size is the amount of money you borrow and the term is the length of time you.

If you read all the questions from beginning to end. Contact New American Funding today to see how much you can save. Get a rough idea of how much you could borrow for a residential mortgage based on your personal circumstances.

Simple Online Application Compare mortgage options and apply in minutes with our streamlined quote and. Your rough mortgage borrowing estimate. How much can you borrow.

Lenders mortgage insurance is an insurance cover that protects a lender if you cant meet required mortgage repayments and default on your loan. These frequently asked questions are arranged in the order in which they occur during the loan origination process. A mortgage is a debt instrument secured by the collateral of specified real estate property that the borrower is obliged to pay back with a predetermined set of payments.

A Residential Owner Occupied rate or Residential Investor rate will apply. Mortgage Payments. Looking to find out how much your client could borrow.

Flexible Down Payment Options Pay as little as 5 down for conventional loans or 3 down for eligible applicants. For every calculation well show you the maximum amount your customers could borrow on both a 2 and 5 year product. Lenders generally prefer borrowers that offer a significant deposit.

While every mortgage lender has their own criteria for determining how much you can borrow they all look at the following key factors when calculating a buy to let mortgage. The organizations primary goals are to provide mortgage liquidity assist in affordable housing. Whats more itll take less than a minute to complete.

Use Mortgage Choices borrowing power calculator to work out how much you can borrow for your home loan. In this example the lender would be willing to offer a loan amount of 171000. Use our Residential Mortgage calculator to give you an indication of how much we could lend your clients.

Cash out debt consolidation options available. Just enter your income debts and some other information to get NerdWallets recommendation for how big a mortgage.

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

How Many Times My Salary Can I Borrow For A Mortgage Canadian Real Estate Wealth

Saving For Downpayment Real Estate Infographic Home Selling Tips Home Buying

How Much Can You Save By Paying Off Your Mortgage Earlynever Realized That Pa Payoff Mortgage Paying O Pay Off Mortgage Early Mortgage Payoff Mortgage Tips

Small House Designs Two Story And 1 1 2 Story Houses Central Mortgage And Housing Corp Free Download Borrow And Streaming Internet Archive Small House Design Small House House Design

What Is Loan Origination Types Of Loans Personal Loans Automated System

Steps To Buying A House Buying First Home Home Buying Tips Home Buying

A Home Loan Or Mortgage Is When You Borrow Money From Another Person Or Institution To Pay For A Property Gettos In 2022 The Borrowers Borrow Money Home Loans

Feeling That Homeowner Fomo Here Are Some Tips On How To Get Started With The Home Buying Process Home Buying Process Home Buying Home Financing

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

The Ultimate Real Estate Loan Guide Infographic Health Mortgage Payment Calculator Cleveland Clinic

Upgrading Your Home Ways To Save On Your Mortgage The Packrat Wifey In 2022 Interest Only Mortgage Residential Real Estate Mortgage Free

Mortgage Do S And Don Ts Mortgage Mortgage Tips Mortgage Advice

Reverse Mortgages What To Know Visual Ly Reverse Mortgage Mortgage Info Mortgage Marketing

Use The Interactive Home Loan Calculator To Calculate Your Home Loan Emi Mortgage Amortization Calculator Mortgage Loan Originator Mortgage Payment Calculator

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

P4wcspmjksfkvm